The Singapore residential real estate market is renowned for its stability and strong regulatory framework. Over the last decade, private residential property prices have experienced steady growth with certain districts being the preferred option for most buyers. New launches and resale properties in these prime districts command a premium, reflecting their desirability and exclusivity

To ensure market stability and to prevent the marketing from overheating and as a hedge against short-term speculative investment, the government has implemented certain key measures in a graded manner over the past few years. These are:

These measures are constantly being adjusted to moderate price increases and safeguard the interests of property owners and investors.

The strong demand for real estate in Singapore is further driven by the country's status as an established global wealth hub, its political stability, and its pro-business environment. On the supply side, government land sales and strategic development initiatives play a key role in shaping the market.

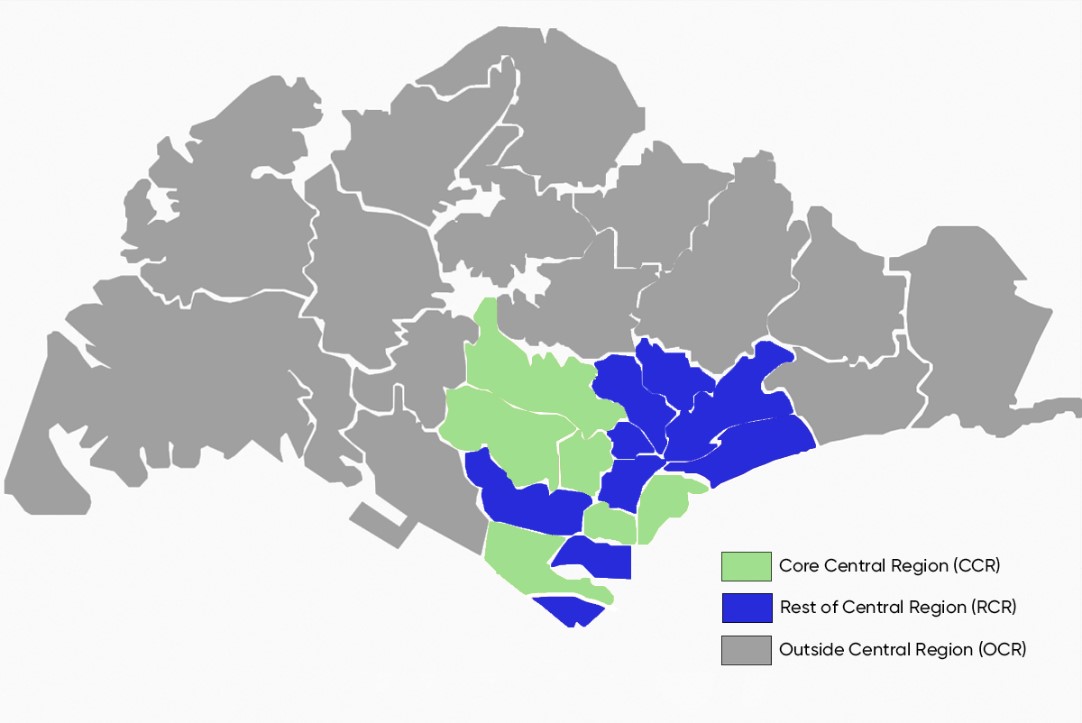

Singapore District Map The Urban Redevelopment Authority (URA) classifies the city into three primary regions: the Core Central Region (CCR), the Rest of Central Region (RCR), and the Outside Central Region (OCR).

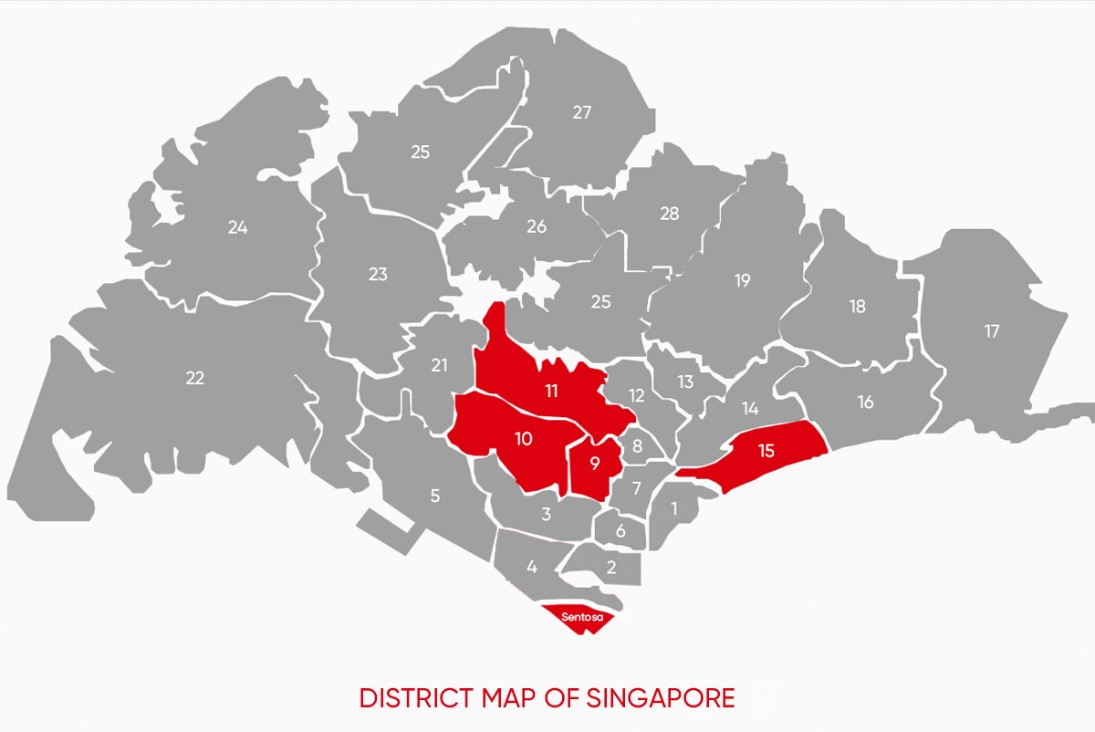

The CCR consists of postal districts 9, 10, and 11, as well as the Downtown Core and Sentosa. The RCR includes the remaining areas within the Central Region that are not part of the CCR, while the OCR covers the planning areas located outside the Central Region.

Singapore is further divided into 28 distinct districts, with prime residential areas including Districts 9, 10, 11, 15, and Sentosa.

| Postal District | Postal Sector (1st 2 digits of 6-digit postal codes) |

General Location |

|---|---|---|

| 1 | 01, 02, 03, 04, 05, 06 | Raffles Place, Cecil, Marina, People's Park |

| 2 | 07, 08 | Anson, Tanjong Pagar |

| 3 | 14, 15, 16 | Queenstown, Tiong Bahru |

| 4 | 09, 10 | Telok Blangah, Harbourfront |

| 5 | 11, 12, 13 | Pasir Panjang, Hong Leong Garden, Clementi New Town |

| 6 | 17 | High Street, Beach Road (part) |

| 7 | 18, 19 | Middle Road, Golden Mile |

| 8 | 20, 21 | Little India |

| 9 | 20, 21 | Little India |

| 10 | 24, 25, 26, 27 | Ardmore, Bukit Timah, Holland Road, Tanglin |

| 11 | 28, 29, 30 | Watten Estate, Novena, Thomson |

| 12 | 31, 32, 33 | Balestier, Toa Payoh, Serangoon |

| 13 | 34, 35, 36, 37 | Macpherson, Braddell |

| 14 | 38, 39, 40, 41 | Geylang, Eunos |

| 15 | 38, 39, 40, 41 | Katong, Joo Chiat, Amber Road |

| 16 | 46, 47, 48 | Bedok, Upper East Coast, Eastwood, Kew Drive |

| 17 | 49, 50, 81 | Loyang, Changi |

| 18 | 51, 52 | Tampines, Pasir Ris |

| 19 | 53, 54, 55, 82 | Serangoon Garden, Hougang, Punggol |

| 20 | 56, 57 | Bishan, Ang Mo Kio |

| 21 | 58, 59 | Upper Bukit Timah, Clementi Park, Ulu Pandan |

| 22 | 60, 61, 62, 63, 64 | Jurong |

| 23 | 65, 66, 67, 68 | Hillview, Dairy Farm, Bukit Panjang, Choa Chu Kang |

| 24 | 69, 70, 71 | Lim Chu Kang, Tengah |

| 25 | 72, 73 | Kranji, Woodgrove |

| 26 | 77, 78 | Upper Thomson, Springleaf |

| 27 | 75, 76 | Yishun, Sembawang |

| 28 | 79, 80 | Seletar |

Singapore’s real estate market continues to thrive due to its political stability, economic strength, and high demand for premium properties. Investing in luxury properties in Singapore ensures steady capital appreciation and rental yields. The city’s strategic location and world-class infrastructure make it a preferred destination for high-net-worth individuals looking for exclusive residences and profitable investment opportunities.

Owning a landed property for sale in Singapore is a desirable combination of a prestigious asset as well as strong capital appreciation. These unique homes offer spacious interiors, private gardens, and exclusivity.

Singapore condo investment is a favourable option due to a lower entry price point, high rental demand and steady capital appreciation.

Premium condos in Singapore come with standard luxury amenities such as fully equipped gyms, swimming pool, other sport facilities, children’s play areas and in many cases concierge services

Key factors to consider when investing in a luxury property in Singapore:

Contact us today for your Singapore real estate requirements today.